- lawyers with “standard” contingency fees

- real estate agents charging the “standard commission”

- used car dealers offering the “standard warranty”

After shopping last week for a “pre-owned vehicle,” I’ve just added Used Car Dealers here in New York State to my list of sellers who use the word “standard” (1) to avoid negotiating with consumers and competing with other sellers, and (2) to imply that the State requires that they offer only the particular option that is being proffered to the consumer on a take-it-or-leave it basis. The word “standard” is employed to convince the consumer that the deal being offered is fair and written in stone.

After shopping last week for a “pre-owned vehicle,” I’ve just added Used Car Dealers here in New York State to my list of sellers who use the word “standard” (1) to avoid negotiating with consumers and competing with other sellers, and (2) to imply that the State requires that they offer only the particular option that is being proffered to the consumer on a take-it-or-leave it basis. The word “standard” is employed to convince the consumer that the deal being offered is fair and written in stone.

It’s no secret that lawyers, real estate agents and used car salesmen are consistently rated among the least respected or least trusted professions. See, e.g., here, and here, there and there; and this cartoon. In my opinion, the standard-deal ploy alone goes a long way to justify the poor reputations.

This posting will focus on the “standard used car warranty” issue. We’ve discussed the first two culprits on the list in prior posts:

- lawyers offering only the “standard contingency fee” in personal injury cases, rather than basing their fee on the level of risk being assumed by the lawyer, as required under ethics standards — see, e.g., our four-part essay on contingency fees

- realtors requiring that you pay the local “standard commission” when selling a house and taking other steps to stifle innovation and competition — see our post “realtors and legislators are selling you out” (Oct. 21, 2005); and the American Antitrust Institute Symposium on Competition in the Residential Real Estate Brokerage Industry (2005). But, note a very recent, positive antitrust outcome: “Justice Dept. Announces Settlement NAR: Settlement Will Result in More Choices, Better Services and Lower Commission Rates For Consumers” (U.S. Department of Justice, Press Release, May 27, 2008). The settlement is discussed by the AAI, in “DOJ-NAR Real Estate Settlement a Milestone for Consumers, But…” (May 27, 2008); and by Consumer Law & Policy Blog (May 29, 2008); and Antitrust Review (May 27, 2008)

While p/i lawyers apply the word “standard” to what is actually the maximum contingency fee percentage permitted in their jurisdiction, used car dealers (in New York State, and probably other states with similar laws) use the term “standard” to describe what is really the minimum warranty periods and terms required by the State, and often to suggest that the State won’t let them offer longer warranties.

While p/i lawyers apply the word “standard” to what is actually the maximum contingency fee percentage permitted in their jurisdiction, used car dealers (in New York State, and probably other states with similar laws) use the term “standard” to describe what is really the minimum warranty periods and terms required by the State, and often to suggest that the State won’t let them offer longer warranties.

Disclaimer: Before I begin this discussion, I want to make clear that I did not start out last week to do an investigation of used car warranty practices. Quite simply, I needed to purchase an inexpensive, reliable, fuel-efficient vehicle — which meant that I’d be buying an older used car, probably with lots of mileage on the odometer. In addition, having no professional or personal experience with Lemon Laws ,or buying used cars from dealers in New York State, I only had a vague recollection that there was some kind of state-mandated warranty.

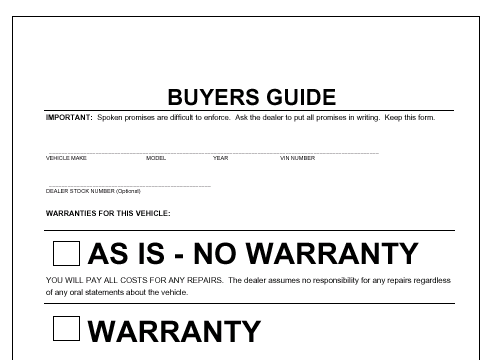

On the other hand, the very first time I saw a Buyers Guide in a used car window last week, I flashed back to a prior life of mine: Thirty years ago, I was an Assistant to the Director in the Federal Trade Commission’s Bureau of Consumer Protection, and one duty was to review the staff’s findings and recommendations in the Commission’s Used Car Rule investigation. In that role, I was (to my knowledge) the very first person to suggest that the FTC require all used car dealers to say in writing, and show it prominently in the window of each car by checking a box, whether the dealer was giving a warranty with the vehicle or selling it “As Is.” That might have gotten my old Consumer and Competition Advocate juices flowing. [At the time, I told my boss Albert Kramer the idea came to me while waiting to play tennis on a Saturday morning, and Al — who typically worked 7-day a week — liked the idea so much he said I should play tennis more often.]

Now that I have had a chance to look at the relevant NYS law and FTC regulation, I realize that many of the dozen dealerships I stopped at last week were in blatant violation of the rules for displaying the warranty information. I am not going to discuss that problem, but hope the NYS Attorney General’s office will start monitoring compliance more closely.

New York State has a Used Car Lemon Law Consumer Bill of Rights (General Business Law, section 198-b. Sale or Lease of Used Motor Vehicles). Under the Bill of Rights, a consumer must be given a written warranty, covering a list of specific systems and items, if he or she purchases or leases a used car sold for (or valued in the lease at) “more than one thousand five hundred dollars . . . from anyone selling or leasing three or more used cars a year.” In addition (emphasis added):

New York State has a Used Car Lemon Law Consumer Bill of Rights (General Business Law, section 198-b. Sale or Lease of Used Motor Vehicles). Under the Bill of Rights, a consumer must be given a written warranty, covering a list of specific systems and items, if he or she purchases or leases a used car sold for (or valued in the lease at) “more than one thousand five hundred dollars . . . from anyone selling or leasing three or more used cars a year.” In addition (emphasis added):

b. Written Warranty required; terms.

1. No dealer shall sell or lease a used motor vehicle to a consumer without giving the consumer a written warranty which shall at minimum apply for the following terms:

(a) If the used motor vehicle has thirty-six thousand miles or less, the warranty shall be at minimum ninety days or four thousand miles, whichever comes first.

(b) If the used motor vehicle has more than thirty-six thousand miles, but less than eighty thousand miles, the warranty shall be at minimum sixty days or three thousand miles, whichever comes first.

(c) If the used motor vehicle has eighty thousand miles or more but no more than one hundred thousand miles, the warranty shall be at a minimum thirty days or one thousand miles, whichever comes first.

See the New York State New Car Lemon Law Consumer Bill of Rights (PDF)

Despite the clear statutory language indicating that the law mandates minimum periods for the required warranty (depending on the vehicle’s mileage), and not a maximum or immutable warranty term, every salesman I asked about the length of the warranty immediately used the non-statutory phrase “standard warranty,” and most added a few garbled words that indicated that the State set the terms, and appeared to blame the state for the lack of a longer period.

At one new-car dealer, a young salesman was (or acted) totally befuddled at the notion that a warranty could be extended beyond the statutory period. The notion was so foreign to him, you would have thought I had asked him to throw in his first-born son, or the dealer’s cute daughter (who appears in their tv ads). He finally said he was certain the dealership — which obviously had its own large service department — would not consider making the warranty longer (which was only 30 days on the vehicle in question). Not even worth walking over to his supervisor to broach the subject.

Raising the “standard warranty” flag is meant to cut off the discussion of warranty periods. But, for many wary, mechanically-challenged consumers, the length of the warranty can be very important. It is an indication of the dealer’s faith in the condition of the vehicle, or willingness to back up words with deeds. As such, it seems to me that at least some dealers should be willing to compete — if not in ads, then to close or sweeten a particular deal — by offering more than the rather short statutory minimum terms. That is especially true if the dealer “self-insures” by performing any needed repairs itself. As with lawyers and real estate agents, however, the Standard Ploy appears to also signal to other sellers that no competition will break out over that aspect of the sale.

My life-long belief as a consumer advocate is that information and options fuel competition and help assure that consumers can achieve fair results in the marketplace. Not knowing that the required State warranty is a minimum requirement greatly hampers the ability of the consumer to bargain for longer coverage and to motive dealers to compete over warranty terms. Unfortunately, the New York State Attorney General — who enforces the law and is the prime source of educational materials on the subject — shoulders a large amount of the blame for the lack of information and the resulting dealer-based misinformation.

For example, the NYS Used Car Lemon Law Fact Sheet does not mention anywhere that the warranty periods are minimums. Indeed, it compounds the problem, fueling the Standard-Statutory-Ploy by showing the following table, which is labelled “Statutory Warranty Length:”

Miles of Operation Duration of Warranty

18,001-36,000 miles 90 days or 4,000 miles

36,001-79,999 miles 60 days or 3,000 miles

80,000-100,000 miles 30 days or 1,000 miles

In addition, the booklet New York’s Used Car Lemon Law: A Guide for Consumers (revised January 2008) does not mention the length of the warranty until page 4, and does not use the statute’s “at minimum” language, or say anything at that point about it being the shortest period permitted:

14. HOW LONG IS THE LEMON LAW WARRANTY PROTECTION?

Miles at time of Duration of

Purchase or Lease Warranty (the earlier of):

_______________ _______________

18,001 to 36,000 90 days or 4,000 miles

36,001 to 79,999 60 days or 3,000 miles

80,000 to 100,000 30 days or 1,000 miles

It is not until page 6 of the Consumers Guide that we see this question and answer:

18. CAN A DEALER GIVE ADDITIONAL WARRANTY PROTECTION?

Yes. A dealer may agree, as part of the sale or lease, to give you more warranty protection than the law requires. The lemon law warranty sets only minimum obligations for dealers.

Those two sentences are the only mention in this 36-page document of the dealer’s ability to “give” or agree to a longer warranty period. Nowhere is the consumer directly told of his or her right to ask or bargain for a longer period.

Indeed, although the actual Used Car Lemon Law Bill of Rights specifically says that the “warranty must be provided for at least” 30, 60 or 90 days, depending on the mileage, it appears that many dealers — in violation of the law’s requirement [subsection e] — do not give a copy of the Warranty, with the Bill of Rights, to the buyer “at or before the time the consumer signs the sales or lease contract for the used motor vehicle.” Instead, dealers — including the one that I bought my car from this week — wait until the car is being delivered to the buyer to provide those documents.

In its literature about its Used Car Buyers Guide — which must be posted in every used car sold by any dealer selling five or more vehicles a year — the Federal Trade Commission does a better job highlighting the ability of consumers to bargain for a longer warranty. For example, in its “Facts for Consumers: Buying a Used Car” [PDF] [en español], the Commission says:

“When you buy a used car from a dealer, get the original Buyers Guide that was posted in the vehicle, or a copy. The Guide must reflect any negotiated changes in warranty coverage.” And,

“Dealers who offer a written warranty must complete the warranty section of the Buyers Guide. Because terms and conditions vary, it may be useful to compare and negotiate coverage.”

Unlike New York, the FTC also provides “A Dealer’s Guide to the Used Car Rule.” The Dealers Guide includes this section, which clearly anticipates bargaining with the consumer over warranty terms:

Unlike New York, the FTC also provides “A Dealer’s Guide to the Used Car Rule.” The Dealers Guide includes this section, which clearly anticipates bargaining with the consumer over warranty terms:

Where Should Negotiated Warranty Changes Be Included?

If you and the consumer negotiate changes in the warranty, the Buyers Guide must reflect the changes. For example, if you offer to cover 50 percent of the cost of parts and labor for certain repairs, but agree to cover 100 percent of the cost of parts and labor after negotiating with the customer, you must cross out the “50 percent” disclosure and write in “100 percent.”

Having had no luck at all getting personal injury lawyers to drop the use of a standard contingency fee, I have no great hope that used car dealers and their sales personnel will drop the “standard warranty” language, stop acting as if the State prevents them from offering longer periods, and/or let consumers know that they are willing to bargain over the length of a warranty. I do hope, however, that this posting — plus the nudge I will be sending to New York Attorney General Andrew M. Cuomo, and to a few media outlets — will help inform the used car buyer of the option to bargain over warranty terms. If a new wave of competition breaks out, please let the f/k/a Gang know.

Having had no luck at all getting personal injury lawyers to drop the use of a standard contingency fee, I have no great hope that used car dealers and their sales personnel will drop the “standard warranty” language, stop acting as if the State prevents them from offering longer periods, and/or let consumers know that they are willing to bargain over the length of a warranty. I do hope, however, that this posting — plus the nudge I will be sending to New York Attorney General Andrew M. Cuomo, and to a few media outlets — will help inform the used car buyer of the option to bargain over warranty terms. If a new wave of competition breaks out, please let the f/k/a Gang know.

Meanwhile, I have no option but to offer our readers a few auto-related haiku and senryu:

checking the driver

as I pass a car

just like mine……………………. by John Stevenson from Some of the Silence

cloud-free dawn . . .

the dent in the fender

holds its darkness

……. by George Swede in “dust of summers: RMA 2007”

orig. pub. Acorn 18

traffic jam

a plastic dog

keeps on nodding

……………. Yu Chang– Upstate Dim Sum ((2002/I)

mud-spattered pickup-

four dogs watch

the tavern door…………. Billie Wilson – The Heron’s Nest (Feb. 2001)

first date –

her eyes linger

on the rusted fender…………….. by dagosan

Great Blog! Very entertaining. I’ve just added you to my blogroll and will be a frequent reader.

Comment by James Ferrell — May 30, 2008 @ 4:18 pm

Many thanks, James, for the generous words. Please do visit (and comment) often.

Comment by David Giacalone — May 30, 2008 @ 5:38 pm

Great job, bro’. [No wonder everyone thinks you’re the brighter twin.] I hope this piece is widely read and distributed in the appropriate circles.

Comment by Arthur J. Giacalone — May 31, 2008 @ 10:22 am

This is a technique a salesman could use on a poorly informed consumer. The interesting thing going on in the country (the world?) is that consumers are becoming more informed in their purchases through access to technology. So, as a real estate agent, I have clients coming to me who already understand the whole commission structure we use, who are well informed about property values in the area they are searching, and who know exactly what they want and how much they want to pay. This information is all available to the individual consumer because of the technology available today.

This level of knowledge for the consumer will result in salesmen who can no longer rely on little sayings like “it’s standard.” Informed consumers know when they are being lied to.

Comment by Jeff Royce — June 4, 2008 @ 6:13 pm

Did you ever receive anything back from the Attorney General’s office? I’d like to read an update…

Comment by Dan — February 20, 2009 @ 1:30 pm

Thanks for asking, Dan. I’m sorry to say that I have never heard from the AG’s office.

Comment by David Giacalone — February 20, 2009 @ 1:32 pm