Takeaway: One of the fastest and cheapest ways to win a big audience for your new game is through a well-connected partner. It’s a lot easier to win partners when your product fits their interests and business model – and that needs to be built into your plans from the outset.

Takeaway: One of the fastest and cheapest ways to win a big audience for your new game is through a well-connected partner. It’s a lot easier to win partners when your product fits their interests and business model – and that needs to be built into your plans from the outset.

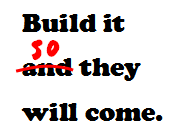

A lot of startups and smaller organizations assume that they have to build their own audience organically. This leaves a lot of great games (and other products) out of the market, unused and un-useful. Getting other organizations to push your games through their existing networks is the fastest way to pull in a sizeable audience for your product – even if you already have a respectable audience of your own.

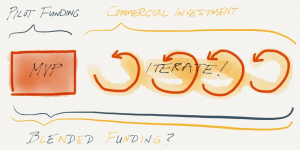

Enduring distribution partnerships can happen by happy accident, but it’s possible to plan ahead – as early as your product strategy and design phase – to make them more likely. After all, it’s one thing to convince someone to Tweet about your awesome new game – it’s another for them to invest their own resources into a meaningful distribution effort. You can design your product to make it easier to secure these partnerships:

What’s in it for them?

Giving your partner tangible incentives for spreading the word is the best way to win real and enduring help:

- Profit. Can your partners resell your product and make profits? This is the clearest way to incentivize a distribution partnership, but it’s not always easy to achieve – read my story below for some caveats.

The various app stores, from iTunes to Edmodo to Steam, all offer access in exchange for profit-sharing – but don’t expect them to elevate your product above the clutter unless you have something extraordinary to offer. You’ll still need to push meaningful sales through sharp marketing, including more substantive partnerships. - Enhancement. Does your product meaningfully complement and enhance your partners’ products, e.g. fill a critical gap or provide a competitive edge? This can ultimately translate into higher profit for your partner, but you may have a harder time claiming a share if you can’t demonstrate direct causation.

- PR. Can your product generate a meaningful boost in awareness, e.g. help win news stories in relevant publications? Note that this is the weakest and most ephemeral of incentives; after the initial flush of excitement, there’s little further incentive to continue promotion.

Does your product match your partners’ business model?

A few years ago I helped an indie game developer market its game for change. Among the most promising assets it had was a revenue-sharing deal with a major international nonprofit. That organization would help promote the game in exchange for a cut of the profits – a win-win for both parties.

Unfortunately, when the time came to promote, this relationship didn’t generate meaningful sales. Why not?

- Audience alignment. While the game was compelling, it was also “hardcore” (e.g. not Candy Crush) and available only on PC. There just weren’t that many hardcore gamers among the nonprofit’s membership.

- Channel mismatch. The nonprofit mostly promoted the game through Twitter. It’s pretty tough generating sales of a PC game through Twitter (a mobile game, maybe). The nonprofit refused to promote through its email list, where there’d be a somewhat higher chance of success. And this was because of:

- Limited incentive. Sure, a cut of the profits is some incentive – but how does that stack against the organization’s other income sources? We’re not talking about GTA5 here; even in the best-case sales scenario, the game would only have generated vanishingly small revenues.

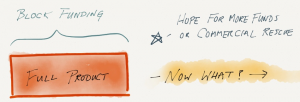

This same analysis applies to educational games and major publishers. Even if your game were a perfect match for a publisher’s content, does it match their marketing and sales strategy? Would the publisher be able to charge more for their existing products if they bundled yours in? Does it merely provide another “talking point” for a sales rep, or can it justify a meaningfully higher sales price? And remember the moral of this story: if the revenue is minimal, a sales team will have little incentive to push a new product.

Does 1 + 1 = 3?

Does your product have qualities that make it synergistic for potential partners?

- Does it transform the partner’s product? For example, does it add new capabilities, especially those with high revenue potential such as assessment, or allow it to sell into a new market segment?

- Is it broad as well as deep? A one-day intervention, no matter how profound, just doesn’t add the same value as something that enhances an entire semester. And make sure it feels coherent: one publisher I recently spoke with scorned mixing-and-matching games from different developers because it would result in a patchwork user experience.

- Is it easy to integrate? For educational games, do your game’s data outputs match existing standards? Are all your games in Flash when your partner has standardized around HTML5?

Don’t just plan. Ask.

Despite everything I’ve written above, the surest way to build meaningful partnerships is to build real relationships with the intended partner. The best way to build a product that your partners will promote is to ask them directly what they’d like to see.