This will be my first post on this new blog (second if you include the “Hello World” post that was automatically created upon account registration). I was hoping to have something more profound to share in a first post, but with less than four days remaining in 2020, I feel it is appropriate to start with a reflection on the past year and end with some thoughts on what I think will happen next.

If you are anything like me, this entire year has felt like one big blur. I am not exaggerating when I say I can barely remember a single meaningful thing that personally happened to me this past year. I believe the culprit behind this is the WFH thrust upon me due to the pandemic. When you are stuck indoors and only able to interact with other people virtually, it is very hard to get those interactions to take root in one’s mind.

When the crisis first began in the early spring, I was highly skeptical of the data coming out from Wuhan and assumed that the Chinese government was lying about the death rate and that the virus was far more dangerous than they were claiming. Back then I was in favor of the (belatedly) cautious approach taken by the US government and I thought the initial lockdowns were completely justified.

Since that time, the data shows strong evidence that the virus is really not that dangerous for most people. Even if one were to accept the “official” numbers of nearly 1.8 million deaths (as of 12/28/2020) at face value, that is still a small proportion of the tens of millions or even hundreds of millions of infected. For reference, in a normal year, nearly 50 to 60 million around the world die from natural causes.

I admit that back in the darkest days of the beginning of the pandemic, I was slightly fearful that COVID-19 could be another “Black Death”-level event (estimated to have killed between 75 million to 200 million of the world’s population in the 14th century) or even comparable to the Spanish Flu of 1918 (estimated to have 17 million to upwards of 100 million deaths). It is clear now that those initial fears were completely overblown.

Now, do not get me wrong, this virus is still deadly and absolutely must be taken seriously. The fact that there are a significant number of cases of young, previously healthy people getting the virus and not fully recovering or having lingering symptoms (so-called “long haulers”) means this is a virus I do not want myself or any of my family and friends to get. Heck, I probably would not even wish this virus on my worst enemy. Thankfully, none of my family or friends have gotten the virus, though one of my colleagues at work has a niece who got the virus back in the spring and has become a “long-hauler” who, despite being young and previously healthy, continues to have lingering symptoms nearly 9 months later.

Yet, while this virus is deadly and must be taken seriously, I do not believe the approach taken by our government has been optimal. The US bungled its initial response to the virus by underreacting and then later did a complete 180 which in my view was an overreaction and overreaching. In essence, the government started treating the virus as the only problem (instead of one of several problems) and that it had to be eliminated at any cost – even if it meant destroying economies or causing more long-term health problems (e.g. missed or deferred surgeries, diagnoses, etc.)

I have been in the Boston area for the entirety of this pandemic, where a strict lockdown was imposed and where I estimate the mask compliance rate is comparable to the 97% of New York City and San Francisco metropolitan areas. Despite all that, we still experienced a second wave with rising cases and deaths. In theory, masks should significantly reduce infection rates. In reality, it is unclear to me whether they are an adequate solution as claimed by the so-called “experts.” The best data illustrating this is that after cities and states imposed mask mandates, infection rates continued to increase. If 95%+ compliance in major cities is ineffective, what will work instead? Is there a significant difference between 95% and 100% compliance?

Again, do not get me wrong, I am not against masks. In fact, I grew up in a country (Japan) in which it is culturally acceptable to wear masks for not only health reasons but even non-health reasons (e.g. women wishing to take a break from makeup, celebrities avoiding paparazzi, etc.). Whenever I venture outside of my home (which is admittedly rare), I am always wearing a mask. Yet, from looking at the data, it seems increasingly harder to justify that wearing masks is a panacea to all of our problems.

It also certainly does not help that many high-profile politicians and leaders in government have privately engaged in hypocritical behavior that run counter to the public messages they have espoused. Just look at stories such as the one of House Speaker Nancy Pelosi visiting an indoor hair salon (breaking a rule that such services needed to be performed outdoors) without properly wearing a mask, or California governor Gavin Newsom going to a dinner party in Napa in violation of heath protocols even after he told Californians to stay at home and avoid gathering in groups.

Some may argue with me that in a country such as the US with its exceptionalism and unbridled optimism, it was inevitable for the virus to spread, but I truly believe that if the government had proper leadership that took the virus seriously much earlier, the country would be in a much better place today.

When we eventually put this pandemic behind us, I am also certain that the results for any given country/region will have more to do with the size/demographics of each country’s population and climate rather than any government policy. Let’s take a look at the US and Africa. Both have terrible healthcare systems and healthcare infrastructure (a topic for another day!), but the number of deaths in Africa have been much lower relative to the US.

Why?

Well, the population in Africa is much younger, and the obesity rate is low (whereas the obesity rate in the US is an absurd 40%) and the weather in Africa on average tends to be warmer than many parts of the US. Am I saying these are the only factors that matter? Of course not, but I am certain they at least partially explain the difference in the death rate.

I would like to eventually shift the tone of this post into an optimistic one, so you may be thinking “What about vaccines?” Alas, despite the enthusiasm surrounding vaccines developed by Pfizer and Moderna, it remains to be seen how many people will actually volunteer to take one of these vaccines. Given that it has been hard to get people to simply wear masks in certain parts of this country, a vaccine feels like it would be an even steeper uphill struggle.

Worth noting that the resistance might not be limited to states in which voters overwhelmingly supported Trump in the recent election, as I recently asked my mother – a left-leaning woman in her sixties living in California who was ecstatic about Biden’s victory in the presidential election – and she said that she was unsure whether she would get the vaccine as soon as it became available. I asked her why and she said that she has “never even gotten a flu shot before…” (perhaps another topic for another day…)

I feel like there are more people out there like my mother than we realize. Reasonable people who have no trouble wearing a mask and following other rules but will take a “wait and see” approach when it comes to the vaccine. If cases and deaths have fallen by spring next year (simply due to warmer weather), then it will give people like my mother even less incentive to take a vaccine.

There might also be logistical challenges involved, as distributing and administering them to millions/billions of people is not an easy task. Indeed, as of this writing, only six percent of the 20 million vaccines that were supposed to be distributed by the end of the year have actually been distributed.

Not to mention that nobody has any idea if there are any side effects or potential risks associated with receiving the vaccine as these vaccines have been developed and rushed out in recording breaking time. Of course, if they work as intended without any negative effects, the overall health situation will definitely improve sometime next year.

Unfortunately, many of the negative aftereffects that resulted from the crisis – the destruction of the job market, the massive expansion of power of the government, and central banks’ QE infinity – will continue long after the virus is eliminated. Let’s start with the first of these. Even if cases and deaths decrease and the overall health situation improves significantly next year, the job market will likely take much longer to recover. It is quite possible that millions of jobs in certain sectors such as hospitality and tourism might never recover to their pre-pandemic levels. Many companies have realized that videoconferencing works just fine and saves time and money, so it seems logical to conclude that business travel will remain at permanently lower levels.

The destroyed job market and resulting unemployment means lower tax revenue and decreased business activity. In response, the government will have no choice but to use the only tools they have at their disposal – namely imposing higher taxes. Though control of the Senate remains up in the air with the Georgia runoffs in early January, I do not think it is unreasonable to assume that we should expect higher taxes (both federal and state), property taxes, capital gains taxes, estate taxes, etc., in the near-term future.

Meanwhile, as the economy remains weak, politicians will propose stimulus checks, rent/mortgage cancellation, and even student loan forgiveness. Such policies will increase deficits and eventually lead to inflation, currency devaluation, and potentially even social unrest. Due to their experience with the pandemic, the government now knows that they have the power to continue imposing restrictions because they have learned that no one is willing to stand up against them. I will not be surprised if we start seeing red tape such as “virus-free certifications” added on top of the existing burdens that small and medium businesses (which make up approximately 50% of employment in the country) already have to deal with. This will especially be the case for businesses that have a physical brick & mortar presence.

These changes result in a nasty vicious cycle. Business activity and tax revenue decrease, so governments respond by increasing taxes while running up the deficit by handing out more “stimulus” money to Americans. At the same time, the government will start imposing more regulations and red tape ostensibly in the interest of “health” and “public safety.” The increased regulations will make it more difficult for companies to hire, which makes the job market become worse, which again results in decreased tax revenue and perpetuating the cycle all over again.

Meanwhile, central banks’ approach to addressing the crisis have been to pursue expansionary monetary policy. If we remember our lessons from Econ 101, an increase in the money supply, all else being equal, will cause a decrease in average interest rates. If the money supply increases faster than the growth in real output, the result will be inflation. Since 2008, the wealthiest Americans have been the beneficiaries of the Fed’s policies, as the stock market, rare artwork, and luxury goods have increased in price at eye-watering rates.

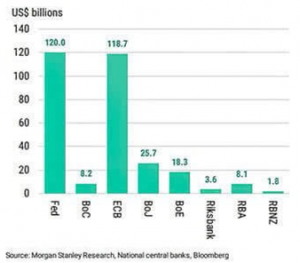

G10 Central Bank Expected Monthly QE in 2021, in USD

Speaking of eye-watering, the S&P 500 is already at unprecedented heights but could easily continue climbing even higher as the money printing continues in 2021 and beyond (see exhibit above).

Stocks such as Tesla – which is worth more than GM, Ford, and Fiat Chrysler combined – can continue to defy reality since hey, who cares about fundamentals anyway?

Many have drawn parallels between today’s bubble to the first dotcom bubble at the turn of the century, but it is important to highlight a key difference. In 1999, the 10-year US treasury yields were at 6% while today the rate is less than 1%

What will cause the music to stop? Or perhaps more importantly, when will the music stop? It is hard to say with any sort of precision, but I think it is safe to say that while the current environment of low economic growth, low inflation and low interest rates can continue for an extended period of time (and with Janet Yellen appointed as Treasury Secretary, perhaps even longer than we think…), it is ultimately unsustainable. At some point there will be an inflection point, where the global economy will take on a new course, whether by design or circumstances. What will be the catalyst for this change?

War?

Another pandemic or health crisis?

Some other man-made catastrophe?

Or a natural catastrophe?

I mentioned earlier in this post that I wanted to end on an optimistic note, and then proceeded to become very pessimistic… So here, finally, are a few positive trends that have emerged over the past year. The first and most obvious is WFH. Although I said at the outset that WFH is one of the reasons the past year became one big blur, I believe the benefits largely outweigh the negatives by a fair margin.

Companies can save time and money, while employees can choose to make decisions about where to live independent of where their employer is located. Obviously, remote work is not realistic or practical for all industries, but for many industries it is likely to be the norm and it is certainly nice to have as an option. Shameless plug: My company Alpha Vantage has been a “remote-first” (working remotely is the default option) company since inception and we are hiring!

Another positive trend that I see emerging is in higher education. Scott Galloway, who teaches marketing at NYU Stern School of Business, put forth the argument earlier this year that the pandemic would serve as the catalyst for an “implosion” in American higher education. A post made in July 2020 on his personal blog shows the analysis of 441 universities in the US that plotted each school across two axes “Value” and “Vulnerability” (each having the “low” or “high” designation for a total of four quadrants).

The best category are the schools that find themselves in the “high value / low vulnerability” quadrant, which he labels “Thrive.” These are composed of “elite schools” which includes most of the Ivy League (curiously Galloway had Brown in the 2nd best category of “Survive”) and other highly selective private schools such as MIT and Stanford as well as a few less selective but reasonably priced public schools that “offer strong value and have an opportunity to emerge stronger” from the pandemic.

The worst category are the schools that find themselves in the “low value / high vulnerability” quadrant, labeled “Perish” “Challenged” (he subsequently updated the label to be less morbid). These are school that are characterized by “high admission rates, high tuition, low endowments, dependence on international students, and weak brand equity.”

The unfortunate reality in the US is that many students graduate (or leave without a degree) saddled with massive amounts of debt and zero job prospects and universities are not held accountable because the onus to repay the debt lies solely with the student. As a result of the pandemic, schools across the nation have found their enrollments plummeting, and many of the less selective but still expensive private schools with small endowments that rely on student tuition will find themselves in dire financial straits. Many of these schools could very well be forced to shut down. Others facing less severe circumstances might be forced to accept more students at lower tuition rates. While I do not necessarily wish for the wholesale collapse of higher education in the US, I can say without hesitation that the current system is broken.

In spite of 2020 and my somewhat pessimistic view of what is to come, I am looking forward to 2021. We will have a new administration and we will have vaccines. How effective both will be remains to be seen, and neither will offset the damage that was caused in 2020, but they do mean that some problems are on their way to being solved, or at least being managed better than they are currently. I am not quite optimistic enough to say that 2021 is going to be an “easy” year, but I am hopeful that it will be “different,” and that this level of different makes it easier for the world to get back on track.

Wishing you all the very best of health, happiness, and success in the new year!

—JOP