My Perspective on the Global Financial Crisis, Political and Economic Approach

My Perspective on the Global Financial Crisis,

Political and Economic Approach

1. Introduction

The most recent financial crisis has badly affected the global economy, including individuals, businesses, and governments. Each entity has suffered its impacts in one way or another (Burger, Coelho, Karpowicz, & Tyson 2009). Since it began, the financial crisis has posed a significant threat to world markets. Countries are trying to overcome the adverse effects of this crisis but have failed to recover their positions due to severe recession and worsening economic conditions (US Department of the Treasury 2012). As we have seen in our class this summer, authors, economists and financial analysts have discussed various reasons for the crisis; the huge downturn in the financial and housing mortgage sector seems to have been the biggest trigger of the crisis (Donath & Cismas 2009). The global financial crisis has hit almost all sectors of the economy, not only hampering industrial growth in countries but also creating serious challenges and issues for governments and regulatory bodies (Independent Evaluation Group 2012).

This paper provides a comprehensive review of the recent global financial crisis, which has shaken the world economy in a short period of time and reduced businesses and governments to helplessness in this recession period. The paper begins with a brief history of the financial crisis: what caused the financial crisis, where it originated, and what economists believe about it. Later sections discuss the different aspects of the global financial crisis, including its main impacts on the different sectors of the economy, the strategies that businesses and governments have been adopting to overcome its consequences and detrimental impacts, and the potential impacts of this financial crisis in both the near future and the long run.

2. History of the Financial Crisis

In 2001, the Federal Reserve in the US began cutting interest rates dramatically to encourage borrowing, which spiked consumption and investment spending. Lower interest rates worked their way into the American economy, and the real estate market began to grow. The number of real estate properties sold, and their prices increased dramatically from 2002 onwards. At the time, the rate on a 30-year fixed-rate mortgage was the lowest it had been in nearly 40 years. Subprime lending and similar mortgage originations in the US increased from less than 8% of all mortgages in 2003 to over 20% in 2006 (Exhibit 1).

The crisis was exacerbated with the bursting of the US housing bubble and high default rates on subprime and adjustable rate mortgages, beginning in approximately 2005–2006. For a number of years prior to that, declining lending standards, an increase in loan incentives, and easy initial terms for borrowers, followed by a long-term trend of rising housing prices had encouraged people to acquire risky mortgages in the belief that borrowers would be able to quickly refinance on more favorable terms.

In late 2006, the largest banks, insurance companies, and other financial institutions in the US noticed a substantial decline in their sales and profitability (Magdoff & Foster 2009). This downturn in financial performance initially was barely discernable, but it increased dramatically over time. The crisis began in the financial sector of the US before spreading to world markets in a considerably short period (Corker 2012). The global financial crisis, after brewing for a while, started to show in the middle of 2007, before accelerating in 2008. Around the world, stock markets showed large losses and financial institutions collapsed or they were bought over. Governments had to come up with emergency rescue packages to bail out their financial systems, which were failing at record speed.

2.1. Housing Finance, Mortgage, and the Subprime Mortgage Crisis

Housing prices peaked in December 2006, when the Federal Reserve was raising short-term interest rates, and then declined by 30% over the subsequent 26 months. (Shefrin, 2009). An estimated 8.8 million homeowners had zero or negative equity as of March 2008, that is, their homes were worth less than their mortgages. The situation produced a “walk away from home” effect, despite the credit rating impact. Increasing foreclosure rates and the unwillingness of many homeowners to sell their homes at reduced market prices significantly increased the supply of housing inventory.

Many economists say that the lack of regulation on financial derivatives led to the financial crisis. In the US, the crisis was mainly triggered by the collapse of financial derivatives known as mortgaged assets, which include prime (borrowers with good credit history) and subprime (borrowers with weak credit history). The Global Financial Crisis was mainly due to the overinvestment of the general public in housing finance and mortgage contracts. Before this financial crisis hit the US market, the housing mortgage and finance market was dominated by a few large commercial banks (Donath & Cismas 2009). They were in stiff competition with local and international banks and financial institutions that offered these facilities at comparatively lower interest rates than did banking institutions (United Nations Organization 2009). In order to contend with these competitors, the local banks in the US reduced their interest rates and made their terms for housing and mortgage facilities more flexible (Burger, Coelho, Karpowicz, & Tyson 2009).

The real estate and financial crisis, caused by a significant increase in mortgage delinquencies and foreclosures, had repercussions for banks and financial markets globally, and weakened the global financial system. In the past years, an estimated 80% of US mortgages held by subprime borrowers were adjustable-rate mortgages. After house prices reached peaked in the middle of 2006, the steep decline that followed made refinancing exceedingly difficult. Adjustable-rate mortgages began to reset at higher rates, resulting in increasing mortgage defaults. Financial firms holding securities backed with subprime mortgages were left with securities with no value. Ultimately, credit around the world was tightening as the capital in many banks and US-government-sponsored enterprises was losing its value.

The crisis can be attributed to a number of factors: the failure of homeowners to meet their mortgage payments, adjustable-rate mortgages resetting along with the extensive lending, overbuilding during the boom period, international trade imbalances, inappropriate government regulation, and speculation. In 2008, the mortgage industry played a crucial role in the recession when an estimated 1.5 million homeowners defaulted on payments and when they were driven to foreclosure by 2009.

After the subprime mortgage crisis spiraled out of control, nearly five million jobs were lost, together with massive loss of wealth and depressed consumer confidence. Several big companies at the heart of the US financial system, such Lehman Brothers and AIG, faltered. In the past years, the rate of home foreclosures had risen dramatically due to defaults on residential mortgages, resulting in the overall meltdown of the US economy and subsequently other countries.

2.2. Bankruptcy of the Largest Banks and Insurance Institutions

As the crisis developed, credit markets froze, banks closed their lending doors to each other, and banking companies and financial institutions had to sell their short-term and long-term securities to pay for the loans, resulting in a significant decline in the volume of their deposits and long-term assets (Magdoff & Foster 2009). When they found no other means of funding those loans, they had to request the government for bailouts (Corker 2012). By September 2008, Lehman Brothers declared bankruptcy without a rescue or bailout, creating fear that the government would allow the financial sector to collapse.

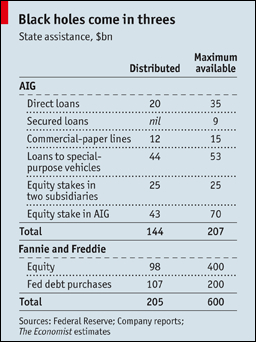

American International Group (AIG), an insurer, and Fannie Mae and Freddie Mac, two mortgage-finance agencies where at the core of the crisis. Fannie Mae and Freddie Mac had owned, guaranteed, and helped securitize about half of American mortgages. These institutions were judged as essential to a healthy housing market; however, their numbers prompted government intervention, which came, as a massive bailout.

2.3. Bailout of the Financial System

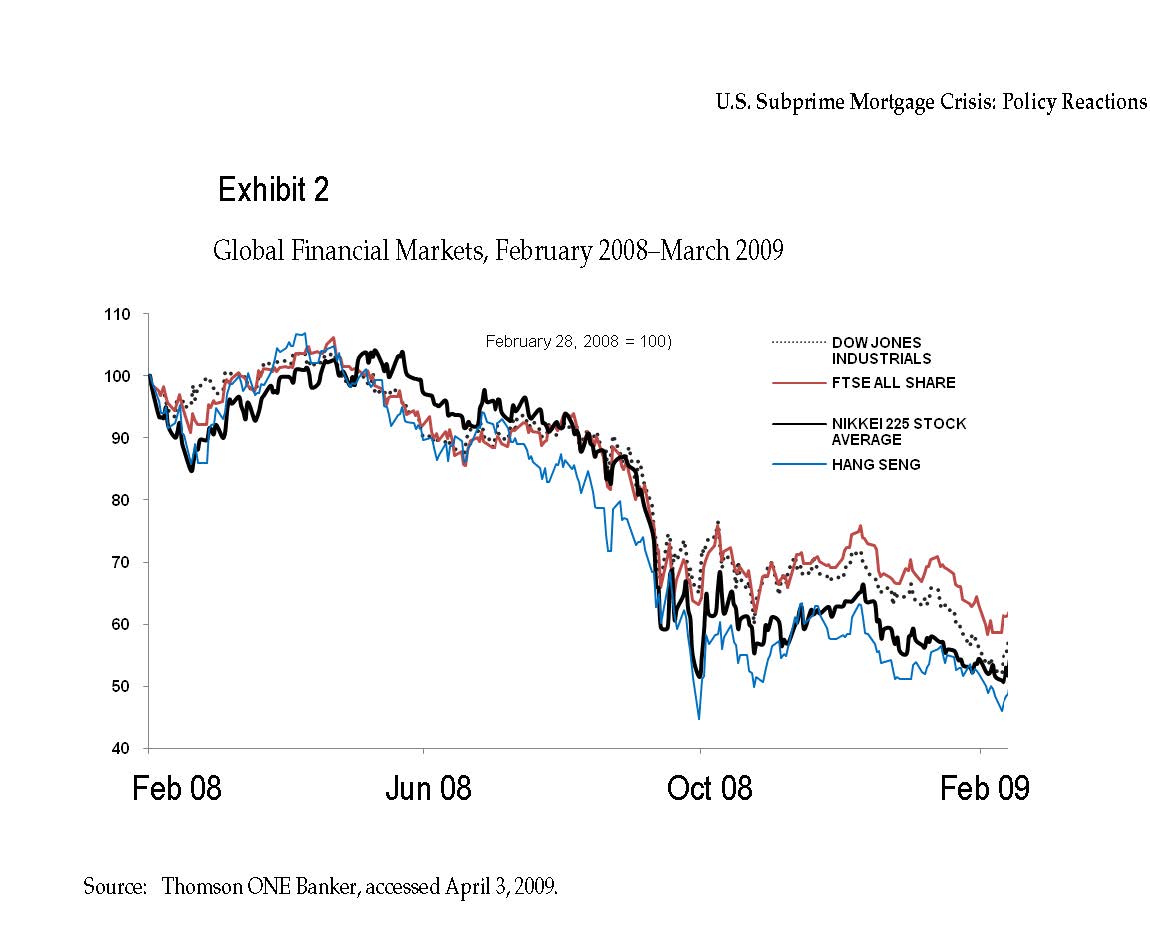

The Fed decided a few days later to save AIG with an $85 billion emergency loan in exchange for an 80% stake in the insurance company, in an attempt to stop the domino effect that was sweeping through the global financial markets (Exhibit 2). Fannie Mae and Freddie Mac, two government-sponsored enterprises (GSEs), were nationalized by the US federal government, transferring $5 trillion of mortgage debt from private to public hands.

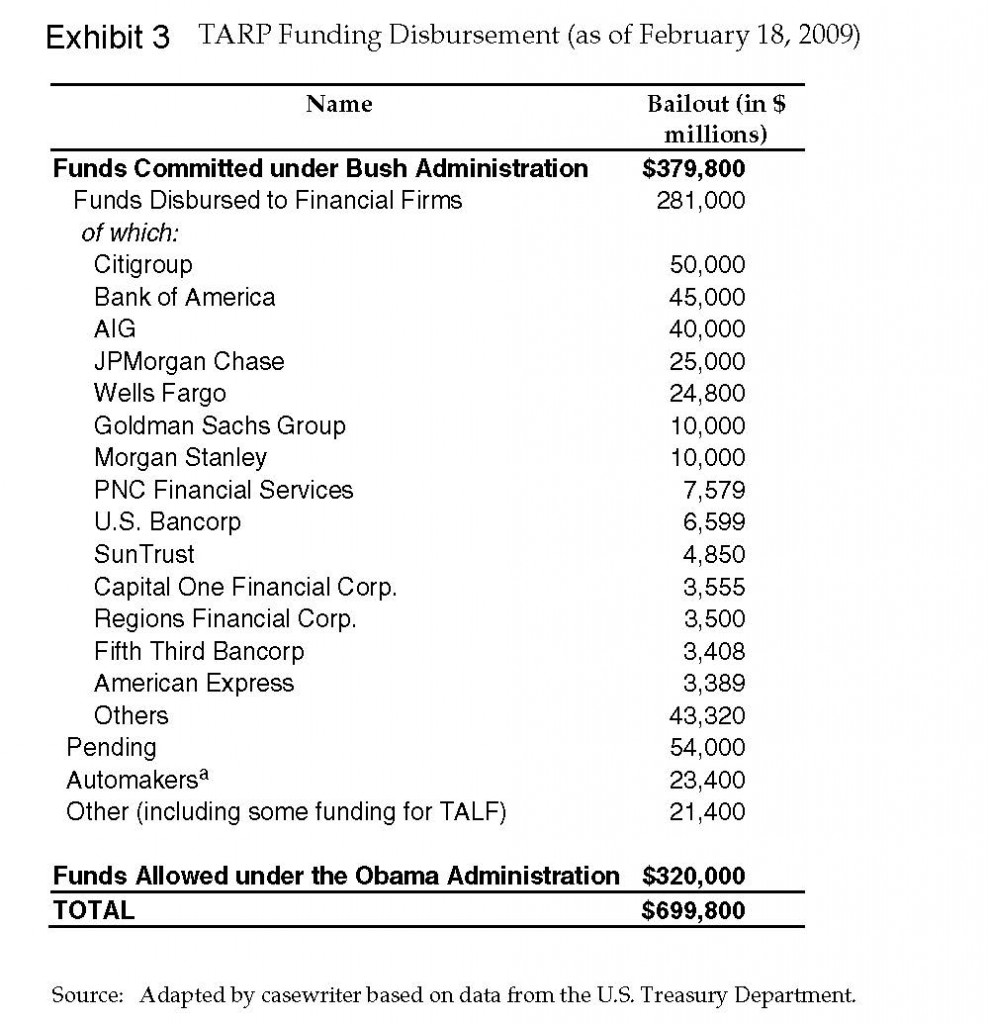

The Treasury Department implemented a key step in October 2008, with a $700 billion financial bailout program called TARP (Troubled Asset Relief Program). This plan also included a ban on short-selling of financial stocks. Consequently, financial institutions like Citigroup, Bank of America, JP Morgan, Wells Fargo, Goldman Sachs and Morgan Stanley, among others, lined up to receive a portion of TARP (see Exhibit 3).

According to “The Economist,” by 2009, the state owned about $170 billion of shares in banks. With the $160 billion of equity invested in the toxic trio, this number rose towards $300 billion. Including other kinds of help, such as loans, the total pumped into the three firms eventually reached $800 billion (Exhibit 4), or 6% of GDP.

In the book “Too Big to Fail,” the author describes how The US government responded by engaging in several proposals to tackle the issue: “The government would buy the toxic assets to get them off the bank’s books, which in turn would raise the value of the assets by establishing a price and make the bank healthier, which in turn would help the economy and, as Paulson repeatedly said, help main street.” Eager to bring life back into the economy, the Bush administration pushed for a stimulus package and created lending programs for banks, and interest rates were dropped to nearly zero. The Federal Reserve also expanded the types of assets it would buy from financial institutions in an effort to ease credit and restore confidence. As the economy showed few signs of recovery, the burden fell on the newly elected president Barack Obama, who faced, in to his first month of presidency, the task to push for a $787 billion bailout package. Across the Atlantic, the British government launched a 500 billion pound bailout to inject capital into the financial system, nationalizing most of the financial institutions in trouble. Many European governments followed as well, to prevent recession, improve liquidity, and boost investor confidence.

3. Present Conditions of the Financial Crisis

The world economy began experiencing the impacts of the crisis when investors from the United Arab Emirates and other rich economies had to face the same debt issues that the financial sector of the US had seen in its housing mortgage and finance facilities. At present, the world economy is in a great recession, where the economic performance of financial institutions has significantly decreased, industrial growth has slowed down, and international trade has been discouraged with the poor economic conditions of a large number of countries in the world (US Senate Committee on Banking, Housing, and Urban Affairs 2012).

Two weeks ago, interest rates on 10-year US Treasury bonds fell to 1.4%, becoming the lowest on record under present or expected inflation, which ranges from 2–3%. Thirty-year Treasury bond rates have fallen to 2.5%. Investors are piling into Treasury bonds and are driving rates downwards, as they are not buying risky stocks or using their cash to expand or create businesses. American investors are protecting themselves against the unknown. Treasury Secretary Tim Geithner reported last week that bank capital had increased 70% to $420 billion from 2009. Home prices are starting to go up while household debt service (monthly payments of interest and principal) as a share of disposable income has dropped to the levels of the early 1990s. Nonetheless, to date, these favorable conditions have been neutralized by the general risk aversion and fearful psychology of people. After all, the Greek and European economic crisis is part of the American’s daily newsfeed.

3.1. European Crisis

The economy of the European Union is made up of 17 nations that use the euro and 10 other nations. The EU is a larger economic bloc than the US or China. The current European economic crisis has been three years in the making, and its outcome is still uncertain. In the case of Greece, there was high fiscal deficit and an attempt to manipulate the numbers prior to the global crisis, to hide debt, which was a result of deficit spending, economic mismanagement, government misreporting, and tax evasion. Even then, it took a long time before this was uncovered. The Greek tragedy has shown to the financial world that no one can any longer mock the critics of high fiscal deficits. Nowadays, countries like Greece, Spain, and Ireland face ongoing recessions crushed by debt, while Germany, the Netherlands, and the International Monetary Fund are pushing for austerity measures.

3.2. Government Policies

The governments of different countries are taking steps to recover the economic positions of the financial and services sector. For this purpose, they are recapitalizing the financial sector so that it becomes stable and recovers its past performance. Moreover, this financial crisis has made a large number of governments run their economies in fiscal deficits. These governments are unable to achieve the Balance of Trade, or to control their expenditures to match their revenues (US Department of the Treasury 2012). Similarly worse conditions are being faced by business organizations in international markets.

As result of this financial crisis, the purchasing power parity of customers has been badly affected, which has resulted in a decrease in the number of customers for each particular product manufactured by international business organizations (Donath & Cismas 2009). This has shrunk the growth and profitability of these organizations and has forced them to keep their business operations limited to their local markets, instead of expanding into new international markets (Burger, Coelho, Karpowicz, & Tyson 2009).

4. Expected Outcomes of the Financial Crisis

The global financial crisis began in the housing sector in a single economy, spreading to all sectors and industries by hitting the entire world economy. A large number of economists and financial analysts that we have studied in Professor J. Grant’s class have presented their views on the expected outcomes and impacts of this global financial crisis in the future. Many of these authors and the US Senate Committee on Banking, Housing, and Urban Affairs believe that this economic crisis will last much longer than previous global crises, which have hit the world economy three times during the previous century. They argue that the recent financial crisis has not finished yet and that it will continue to affect the financial sector and the other sectors in the services industry in the short run (Barth 2009).

4.1. Impacts in the Short Run

The economic downturn will first affect the manufacturing sector, due to which industrial growth will slow down. As a result, economies will experience a significant decrease in Gross Domestic Product and National Income (United Nations Organization 2009). This decrease in GDP and NI will automatically hit the services sector due to poor financial performance and miserable industry conditions (Corker 2012). The repaying abilities of industrial concerns will also decrease, which will restrict them from availing of high-interest, long-term loans from the financial sector (Donath & Cismas 2009).

These negative impacts of the financial crisis will also affect the consumption patterns of individuals, businesses, and governmental agencies. As the US Department of the Treasury 2012 reports, consumers will find it harder to maintain a balance between their incomes and expenditures due to deep recession and high inflationary pressures. They will either shorten their needs or look for substitute products to save money. Similarly, business organizations will feel be hesitant to expand operations in international markets, especially in countries affected by the global financial crisis. Governmental bodies will also cut down their expenditure in view of the increasing fiscal deficits and deep recession in world economies (US Senate Committee on Banking, Housing, and Urban Affairs 2012).

4.2. Impacts in the Long Run

Individuals, businesses, and governments will face the same situation in the long run, when the recession will worsen for both the services and manufacturing sectors. Some researchers and economists believe that the global economic crisis will make it harder and more challenging for governments to revitalize their financial sectors. This is because the world has not yet seen any significant steps taken by the governments of the affected economies to recover the past performance of their financial sectors. For instance, the government of the US has failed to bring its economy out of serious foreign debt, which is rapidly increasing (United Nations Organization 2009).

4.3. Global Economic Outlook through the IMF’s Eyes

According to the International Monetary Fund’s latest forecast, the global economy will experience steady growth over the next two years. Europe’s current financial crisis and a possible budget crisis in the US. could slow world growth even further. The IMF warned that economic conditions could worsen if the US does not deal with a pending budget crisis soon. By the end of 2012, several large tax cuts are set to expire, and massive spending cuts are scheduled to kick in at the same time. If Congress does not take action, the US. could experience another recession and the global economy could slow sharply. This all depends on the upcoming November elections and the measures that the US. president may apply. The IMF’s chief economist, Olivier Blanchard, said, “failure to deal with these issues could cut up to 4 percentage points off US. growth in 2013.”

Regarding Europe, the IMF predicted that even if the 17-nation euro zone follows through with its commitments, the region’s economy would shrink by 0.3% this year and grow by only 0.7% in 2013. German and French economies are expected to grow in 2012 and 2013 at a slow pace, while the economies of Italy and Spain will contract. The IMF expects a slow growth in developing countries due to a decrease in exports to European countries and the US. (IMF report, 2012)

4.4. The Next Decade Deficit

After the panic and dark days of the financial crisis, it is expected that new generations may have an inclination to save and a reluctance to incur debt or borrow money. Today, “too big to fail” private financial institutions are fewer and larger, after having qualified for unlimited taxpayer bailouts. Nonetheless, our nation is facing an enormous deficit that may generate a collapse. According to Arnold Bock from Safe Haven Preservation of Capital, “Rising interest rates are all that is necessary to trigger the Round Two collapse of the ongoing financial crisis.” The US is facing expanding government deficits as well as debt and unfunded liabilities. People and businesses paying fewer taxes due to diminished income are the reason for almost half of the debt in the US.

The US deficit grew under the George Bush administration as a result of the recession. Bush approved the 2009 budget and the bank bailout (TARP). However, the recession itself is the main cause of the deficit. Bush and Reagan increased the debt in good times, while Clinton tried to pay down the debt (Exhibit 5). During the last three years of the Obama administration, national debt has increased more than it did during the eight years of the Bush administration ($4.899 vs. $4.939 trillion, as of March 2012). National debt on August 6, 2012 will reach the staggering amount of $15,993,366,918,897.39 and will keep growing. The estimated US population is 313,266,356, so, each citizen’s share of this debt is approximately $50,862.04 (Debt clock, 2012).

As of today, the national debt exceeds 100% of national GDP. The latest federal budget sent to Congress by Mr. Obama shows that the debt would continue to grow, hitting $16.3 trillion in 2012, $17.5 trillion in 2013, and $25.9 trillion in 2022. If Mr. Obama wins the November elections, and these budget projections prove accurate, national debt will exceed $20 trillion in 2016, the final year of his second term. That would mean that the debt increased by 87%, or $9.34 trillion, during his two terms (Knoller, 2012). According to sources run by political campaigns, from 1789 to 2008, with 43 presidents, the total debt left was approximately $6.3 trillion dollars, and the debt added by President Obama in less than one term is approximately $6.5 trillion dollars.

Considering these alarming numbers, our nation has to become more fiscally responsible: people need to start taking risks, starting businesses and ventures, and we need to fuel the economy, leaving behind the fear acquired through the Global Financial Crisis. This is because the bills have to be paid, and a default is not an option if we want to maintain the good name of the US in global fiscal circles, in order to prevent another global financial crisis. Many economists believe that the debt ceiling needs to be raised, while others think that raising the debt ceiling may be a mistake that will only encourage the same poor decisions that brought us to the initial crisis. Considering that our monetary system was initially built on the gold standard and was then changed to one built on faith, if you lose this faith, then nothing matters.

5. Risk Analysis in the Global Financial Crisis

In order to revive the world economy from the severe financial crisis, businesses and government have adopted different strategies in the recent past. The first of this is the risk analysis of the different factors that caused the financial crisis and badly hampered the industrial growth and economic performance of different entities (Kaufman, 2009). The risks involved in this process include further vulnerability of the financial sector, competition among businesses, and political instability in different economies of the world.

As far as political instability is concerned, the revival programs for stable economies will not be affected because all governments have been taking initiatives to revive their financial sectors and industrial growth (US Senate Committee on Banking, Housing, and Urban Affairs 2012). The second risk factor is competition among businesses, which can affect the revival programs in a negative or positive way. The price war between different businesses can lead to greater competitiveness, but it can also lead to more relaxed terms and conditions, as the world experienced before the recent global financial crisis (French, Baily, Campbell, & Cochrane 2010).

6. Impacts on the Different Sectors of the Economy

The financial sector was not the only industry affected by the global financial crisis: all industries have been affected in one way or another. This section provides an overview of the impacts on different sectors in light of some important economic measures. The overall impact of the financial crisis can be discussed by highlighting its impacts on the inflation rate, balance of trade, monetary policy measures, and economic reform programs taken by governments from time to time (Chorafas 2009). These factors are now discussed below in detail:

6.1. Impacts on Inflationary Pressures

The financial crisis badly affected the value of currency by putting high inflationary pressures on almost every currency of the world. The US Dollar returned to its previous position when the financial crisis hit its economy. Similarly, the value of currencies in the Asian and European markets also depreciated due to low production levels, high trade deficits, and discouraged international trade (Donath & Cismas 2009). Terrorist activities had also increased during the previous three to four years, which discouraged tourism and travel around the globe (UNCTAD 2009). The inflationary pressures also increased for general consumers: it became harder for them to save money for their future needs due to the increasing prices of consumer products. Businesses also experienced high costs of production after the global financial crisis affected their countries (Barth 2009).

6.2. Impacts on the Balance of Trade

The global financial crisis discouraged international trade by making it more expensive for businesses and individuals to import required goods and services from international markets. Exporters were unable to sell their manufactured goods to potential target markets due to decreased demand by importers. These exporters were not supported by their governments, and their trade balances suffered (US Senate Committee on Banking, Housing, and Urban Affairs 2012). These issues resulted in a decreased level of production by manufacturers, which meant they had to run their plants under capacity (International Monetary Fund 2012). This increased their cost of productions and the level of unemployment in their countries. The governments had to take external funding to meet their trade deficits, which increased their interest expenditures (French, Baily, Campbell, & Cochrane 2010).

6.3. Monetary Policy and Economic Reform Programs

Although the steps taken by the governments of different countries for the revival of their economies are largely criticized by business analysts and researchers, the changes in monetary policies and the launch of economic reform programs are two appreciable steps that seem to have effectively beat back the global financial crisis (Chorafas, 2009).

6.3.1. Monetary Policy

Monetary policy measures are being implemented in order to control the flow of money in the economy. Governments are controlling the level of inflation in their countries through tight monetary policies. They have set the discount rates for banking companies higher in order to discourage borrowing (Patterson 2010). Similarly, the inter-bank rate has also been set high in order to discourage lending and borrowing transactions between local banks. Economic reforms by the governments of different countries include encouragement of foreign direct investment in their countries, running industries on full capacity, and supporting micro financing in rural areas (Nanto, 2009).

6.3.2. Foreign Direct Investment

Attracting potential investors to come and do business in new international markets encourages foreign direct investment. Governments are attracting these investors by offering relaxed terms and conditions for setting up and operating their businesses. For example, the introduction of tax free zones, easy financing facilities, and regulatory conditions are few steps to attract these investors.

6.3.3. Revitalizing the Industrial Sector

Offering easy financing facilities to increase capacity and level of production is revitalizing industries. These steps also help in increasing foreign direct investment. Donath and Cismas (2009) believe that industrial growth is the strongest weapon in beating the global financial crisis. An economy can only grow if its industries are running at their full capacity and contributing a big part to the GDP. The revitalization process of the industrial sector will also help the economies by decreasing the level of unemployment and improving the social status of the consumers (French, Baily, Campbell, & Cochrane 2010).

7. Conclusion

The global economic crisis began in the housing sector and spread to all sectors of the world economy (Magdoff & Foster 2009). Overinvestment by the general public in housing mortgages was the main reason for this crisis, which led to severe economic conditions in the entire international business and economic environment (International Monetary Fund 2012). Economists believe that the financial crisis was mainly due to the price war between banking companies, which forced them to charge very low prices for their services. The financial crisis soon entered the world markets and caused a deep recession, which is still affecting major parts of the world (French, Baily, Campbell, & Cochrane 2010).

The expected outcomes of the global economic crisis are presented by the researchers and analysts in two opposite perspectives; one camp believes that the crisis will worsen in the future while the other argues that the maximum period for which this crisis will affect the world economy is one decade (US Department of the Treasury 2012). In either case, world markets will have to struggle to recover their previous positions. The governments of different countries have taken numerous steps to revitalize their economies (US Senate Committee on Banking, Housing, and Urban Affairs 2012). The tightening of monetary policies, encouragement of foreign direct investments, and supporting of industrial sectors are the most significant steps in this respect (Chorafas 2009).

From the above discussion, it can be concluded that every single entity in the world has been affected by the recent global financial crisis (Independent Evaluation Group 2012). The inflationary pressures, unemployment, balance of trade, fiscal deficits, and poor financial performance of major industries are some notable negative impacts of this crisis (Burger, Coelho, Karpowicz, & Tyson 2009).

8. Exhibits

Exhibit 1

Exhibit 2

Exhibit 3

Automakers include General Motors, Chrysler, and GMAC, General Motors’ financing arm. The automakers requested additional funding in February 2009.

Exhibit 4

Exhibit 5

9. References

AIG, Fannie Mae and Freddie Mac: The toxic trio | The Economist. (n.d.). Retrieved from http://www.economist.com/node/14214879

Barth, J.R. 2009, The Rise and Fall of the US Mortgage and Credit markets: a Comprehensive Analysis of the Market Meltdown. Hoboken, N.J: J. Wiley & Sons

Burger, P., Coelho, M.D., Karpowicz, I., & Tyson, J. 2009, The Effects of the Financial Crisis on Public-private Partnerships. Washington, DC: International Monetary Fund working paper

Chorafas, D.N. 2009, Financial Boom and Gloom: The Credit and Banking Crisis of 2007-2009 and Beyond. US: Palgrave Macmillan Studies in Banking and Financial Institutions

Corker, B. 2012, Senate Banking Committee Hearing on Financial Crisis. Available from <http://www.corker.senate.gov/public/index.cfm?p=SenateBankingCommitteeHearingonFinancialCrisis> [Accessed August 4th, 2012]

Donath, L.E., & Cismas, L.M. 2009, The Current Financial Crisis Revisited – Causes and Remedies, the Romanian Economic Journal, 31 (1): 85-92. <http://www.rejournal.eu/Portals/0/Arhiva/JE%2031/JE%2031%20-%20DONATH%20CISMAS.pdf>

French, K.R., Baily, M.N., Campbell, J.Y., & Cochrane, J.H. 2010, The Squam Lake Report: Fixing the Financial System. N.Y: Princeton University Press

Independent Evaluation Group, 2012. The World Bank Group’s Response to the Global Economic Crisis. Available from <http://www.worldbank.org/ieg/crisis/> [Accessed August 4th, 2012]

IMF Survey: IMF Marks Down Global Growth Forecast, Sees Risk… (n.d.). Retrieved from http://www.imf.org/external/pubs/ft/survey/so/2012/NEW012412A.htm

International Monetary Fund, 2012. Key Issues: Financial Crisis. Available from <http://www.imf.org/external/np/exr/key/finstab.htm> [Accessed August 4th, 2012]

Kaufman, H., 2009, The Road to Financial Reformation: Warnings, Consequences, Reforms. Hoboken, N.J.: John Wiley & Sons

Knoller, M, 2012, Obama Ad Casts Romney as Deficit-Driver Like Bush – ABC News, http://abcnews.go.com/blogs/politics/2012/07/obama-ad-casts-romney-as-deficit-dr iver-like-bush/ (accessed August 6, 2012).

Krugman, P. 2008, the Return of Depression Economics. N.Y: W.W. Norton & Company

Magdoff, F., & Foster, J.B. 2009, The Great Financial Crisis: Causes and Consequences. N.Y: Monthly Review Press

Nanto, D.K. 2009, the Global Financial Crisis: Analysis and Policy Implications. Congressional Research Service, 7-5700. Available from <http://www.fas.org/sgp/crs/misc/RL34742.pdf> [Accessed August 4th, 2012]

Patterson, S. 2010, the Quants: How a New Breed of Math Whizzes Conquered Wall Street and Nearly Destroyed It, 1st Edition. N.Y: Crown Publishing Group

Hersh Shefrin, How Psychological Pitfalls Generated the Global Financial Crisis.Research Foundation Publications, Insights into the Global Financial Crisis (December 2009): 224-256.

Sorkin Andrew, Too big to fail, The Inside Story of How Wall Street and Washington Fought to Save the Financial System—and Themselves, Viking Adult; First edition (October 20, 2009)

UNCTAD, 2009, Assessing the Impact of the Current Financial and Economic Crisis on Global FDI Flows. United Nations Publications. P 3-20. Available from <http://www.unctad.org/en/docs/webdiaeia20091_en.pdf> [Accessed August 4th, 2012]

United Nations Organization, 2009, The Global Financial Crisis – the Response of the Regional Commissions. United Nations Publications. Available from <http://www.un.org/regionalcommissions/crisis/global.pdf> [Accessed August 4th, 2012]

US Department of the Treasury, 2012, The Response to the Financial Crisis – In Charts. Available from <http://www.treasury.gov/connect/blog/Pages/financial-crisis-response-in-charts.aspx> [Accessed August 4th, 2012]

US Senate Committee on Banking, Housing, and Urban Affairs, 2012, The European Debt and Financial Crisis: Origins, Options, and Implications of the US and Global Economy. Available from <http://banking.senate.gov/public/index.cfm?Fuseaction=Hearings.Hearing&Hearing_ID=a946a668-dbb6-47e3-b8b4-07da5c413819> [Accessed August 4th, 2012]

World Bank, 2012. Financial Crisis. Available from <http://www.worldbank.org/financialcrisis/> [Accessed August 4th, 2012]

Rocco Freymuth

July 24, 2013 @ 7:32 pm

Bel sito. Si dovrebbe pensare di più sui feed RSS come fonte di traffico. Mi portano un bel po ‘di traffico

vapor pens

June 1, 2014 @ 7:15 am

Your style is so unique compared to other people I’ve read stuff

from. Thank you for posting when you’ve got the opportunity, Guess I will just

bookmark this web site.