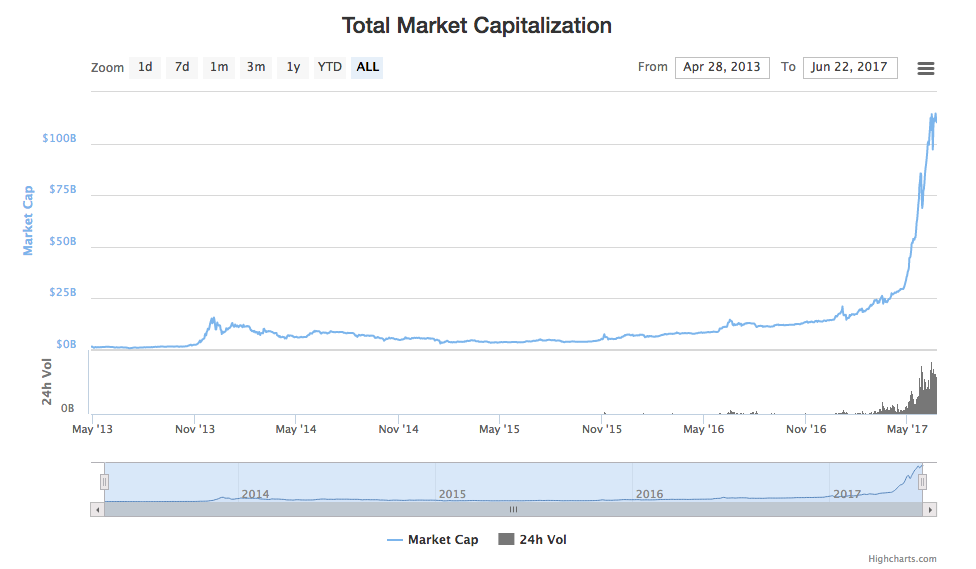

Take a look at this chart:

CryptoCurrency Market Capitalizations

As Neo said, Whoa.

To help me get my head fully around all that’s going on behind that surge, or mania, or whatever it is, I’ve composed a lexicon-in-process that I’m publishing here so I can find it again. Here goes:::

Bitcoin. “A cryptocurrency and a digital payment system invented by an unknown programmer, or a group of programmers, under the name Satoshi Nakamoto. It was released as open-source software in 2009. The system is peer-to-peer, and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes and recorded in a public distributed ledger called a blockchain. Since the system works without a central repository or single administrator, bitcoin is called the first decentralized digital currency.” (Wikipedia.)

Cryptocurrency. “A digital asset designed to work as a medium of exchange using cryptography to secure the transactions and to control the creation of additional units of the currency. Cryptocurrencies are a subset of alternative currencies, or specifically of digital currencies. Bitcoin became the first decentralized cryptocurrency in 2009. Since then, numerous cryptocurrencies have been created. These are frequently called altcoins, as a blend of bitcoin alternative. Bitcoin and its derivatives use decentralized control as opposed to centralized electronic money/centralized banking systems. The decentralized control is related to the use of bitcoin’s blockchain transaction database in the role of a distributed ledger.” (Wikipedia.)

“A cryptocurrency system is a network that utilizes cryptography to secure transactions in a verifiable database that cannot be changed without being noticed.” (Tim Swanson, in Consensus-as-a-service: a brief report on the emergence of permissioned, distributed ledger systems.)

Distributed ledger. Also called a shared ledger, it is “a consensus of replicated, shared, and synchronized digital data geographically spread across multiple sites, countries, or institutions.” (Wikipedia, citing a report by the UK Government Chief Scientific Adviser: Distributed Ledger Technology: beyond block chain.) A distributed ledger requires a peer-to-peer network and consensus algorithms to ensure replication across nodes. The ledger is sometimes also called a distributed database. Tim Swanson adds that a distributed ledger system is “a network that fits into a new platform category. It typically utilizes cryptocurrency-inspired technology and perhaps even part of the Bitcoin or Ethereum network itself, to verify or store votes (e.g., hashes). While some of the platforms use tokens, they are intended more as receipts and not necessarily as commodities or currencies in and of themselves.”

Blockchain.”A peer-to-peer distributed ledger forged by consensus, combined with a system for ‘smart contracts’ and other assistive technologies. Together these can be used to build a new generation of transactional applications that establishes trust, accountability and transparency at their core, while streamlining business processes and legal constraints.” (Hyperledger.)

“To use conventional banking as an analogy, the blockchain is like a full history of banking transactions. Bitcoin transactions are entered chronologically in a blockchain just the way bank transactions are. Blocks, meanwhile, are like individual bank statements. Based on the Bitcoin protocol, the blockchain database is shared by all nodes participating in a system. The full copy of the blockchain has records of every Bitcoin transaction ever executed. It can thus provide insight about facts like how much value belonged a particular address at any point in the past. The ever-growing size of the blockchain is considered by some to be a problem due to issues like storage and synchronization. On an average, every 10 minutes, a new block is appended to the block chain through mining.” (Investopedia.)

“Think of it as an operating system for marketplaces, data-sharing networks, micro-currencies, and decentralized digital communities. It has the potential to vastly reduce the cost and complexity of getting things done in the real world.” (Hyperledger.)

Permissionless system. “A permissionless system [or ledger] is one in which identity of participants is either pseudonymous or even anonymous. Bitcoin was originally designed with permissionless parameters although as of this writing many of the on-ramps and off-ramps for Bitcoin are increasingly permission-based. (Tim Swanson.)

Permissioned system. “A permissioned system -[or ledger] is one in which identity for users is whitelisted (or blacklisted) through some type of KYB or KYC procedure; it is the common method of managing identity in traditional finance.” (Tim Swanson)

Mining. “The process by which transactions are verified and added to the public ledger, known as the blockchain. (It is) also the means through which new bitcoin are released. Anyone with access to the Internet and suitable hardware can participate in mining. The mining process involves compiling recent transactions into blocks and trying to solve a computationally difficult puzzle. The participant who first solves the puzzle gets to place the next block on the block chain and claim the rewards. The rewards, which incentivize mining, are both the transaction fees associated with the transactions compiled in the block as well as newly released bitcoin.” (Investopedia.)

Ethereum. “An open-source, public, blockchain-based distributed computing platform featuring smart contract (scripting) functionality, which facilitates online contractual agreements. It provides a decentralized Turing-complete virtual machine, the Ethereum Virtual Machine (EVM), which can execute scripts using an international network of public nodes. Ethereum also provides a cryptocurrency token called “ether”, which can be transferred between accounts and used to compensate participant nodes for computations performed. Gas, an internal transaction pricing mechanism, is used to mitigate spam and allocate resources on the network. Ethereum was proposed in late 2013 by Vitalik Buterin, a cryptocurrency researcher and programmer. Development was funded by an online crowdsale during July–August 2014. The system went live on 30 July 2015, with 11.9 million coins “premined” for the crowdsale… In 2016 Ethereum was forked into two blockchains, as a result of the collapse of The DAO project. The two chains have different numbers of users, and the minority fork was renamed to Ethereum Classic.” (Wikipedia.)

Decentralized Autonomous Organization. This is “an organization that is run through rules encoded as computer programs called smart contracts. A DAO’s financial transaction record and program rules are maintained on a blockchain… The precise legal status of this type of business organization is unclear. The best-known example was The DAO, a DAO for venture capital funding, which was launched with $150 million in crowdfunding in June 2016 and was immediately hacked and drained of US$50 million in cryptocurrency… This approach eliminates the need to involve a bilaterally accepted trusted third party in a financial transaction, thus simplifying the sequence. The costs of a blockchain enabled transaction and of making available the associated data may be substantially lessened by the elimination of both the trusted third party and of the need for repetitious recording of contract exchanges in different records: for example, the blockchain data could in principle, if regulatory structures permitted, replace public documents such as deeds and titles. In theory, a blockchain approach allows multiple cloud computing users to enter a loosely coupled peer-to-peer smart contract collaboration.(Wikipedia)

Initial Coin Offering. “A means of crowdfunding the release of a new cryptocurrency. Generally, tokens for the new cryptocurrency are sold to raise money for technical development before the cryptocurrency is released. Unlike an initial public offering (IPO), acquisition of the tokens does not grant ownership in the company developing the new cryptocurrency. And unlike an IPO, there is little or no government regulation of an ICO.” (Chris Skinner.)

“In an ICO campaign, a percentage of the cryptocurrency is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, but usually for Bitcoin…During the ICO campaign, enthusiasts and supporters of the firm’s initiative buy some of the distributed cryptocoins with fiat or virtual currency. These coins are referred to as tokens and are similar to shares of a company sold to investors in an Initial Public Offering (IPO) transaction.” (Investopedia.)

Tokens. “In the blockchain world, a token is a tiny fraction of a cryptocurrency (bitcoin, ether, etc) that has a value usually less than 1/1000th of a cent, so the value is essentially nothing, but it can still go onto the blockchain…This sliver of currency can carry code that represents value in the real world — the ownership of a diamond, a plot of land, a dollar, a share of stock, another cryptocurrency, etc. Tokens represent ownership of the underlying asset and can be traded freely. One way to understand it is that you can trade physical gold, which is expensive and difficult to move around, or you can just trade tokens that represent gold. In most cases, it makes more sense to trade the token than the asset. Tokens can always be redeemed for their underlying asset, though that can often be a difficult and expensive process. Though technically they could be redeemed, many tokens are designed never to be redeemed but traded forever. On the other hand, a ticket is a token that is designed to be redeemed and may or may not be trade-able” (TokenFactory.)

“Tokens in the ethereum ecosystem can represent any fungible tradable good: coins, loyalty points, gold certificates, IOUs, in game items, etc. Since all tokens implement some basic features in a standard way, this also means that your token will be instantly compatible with the ethereum wallet and any other client or contract that uses the same standards. (Ethereum.org/token.)

“The most important takehome is that tokens are not equity, but are more similar to paid API keys. Nevertheless, they may represent a >1000X improvement in the time-to-liquidity and a >100X improvement in the size of the buyer base relative to traditional means for US technology financing — like a Kickstarter on steroids.” (Thoughts on Tokens, by Balaji S. Srinivasan.)

“A blockchain token is a digital token created on a blockchain as part of a decentralized software protocol. There are many different types of blockchain tokens, each with varying characteristics and uses. Some blockchain tokens, like Bitcoin, function as a digital currency. Others can represent a right to tangible assets like gold or real estate. Blockchain tokens can also be used in new protocols and networks to create distributed applications. These tokens are sometimes also referred to as App Coins or Protocol Tokens. These types of tokens represent the next phase of innovation in blockchain technology, and the potential for new types of business models that are decentralized – for example, cloud computing without Amazon, social networks without Facebook, or online marketplaces without eBay. However, there are a number of difficult legal questions surrounding blockchain tokens. For example, some tokens, depending on their features, may be subject to US federal or state securities laws. This would mean, among other things, that it is illegal to offer them for sale to US residents except by registration or exemption. Similar rules apply in many other countries. (A Securities Law Framework for Blockchain Tokens.)

In fact tokens go back. All the way.

In Before Writing Volume I: From Counting to Cuneiform, Denise Schmandt-Besserat writes, “Tokens can be traced to the Neolithic period starting about 8000 B.C. They evolved following the needs of the economy, at first keeping track of the products of farming…The substitution of signs for tokens was the first step toward writing.” (For a compression of her vast scholarship on the matter, read Tokens: their Significance for the Origin of Counting and Writing.

I sense that we are now at a threshold no less pregnant with possibilities than we were when ancestors in Mesopotamia rolled clay into shapes, made marks on them and invented t-commerce.

And here is a running list of sources I’ve visited, so far:

- 500 Startups

- Ambisafe

- AME Cloud Ventures

- Andreessen Horowitz

- Angel.co’s list of blockchains investors (774 so far)

- Ben Dickson (@bendee983)

- Bitcoin Exchange Guide

- Bitcoin Forum and its Cryptocurrency, Tokens and Altcoins list

- Bitcoin Talk forum

- Blockchain Capital

- Blockstack, with Muneeb Ali and @RyanShea

- Boost VC

- Carlota Perez (see Fred Wison’s HT to her work)

- Chris Skinner’s blog

- Coindesk

- CoinFund Slack channel

- CoinMarketCap (also see charts)

- CoinSchedule

- CryptoCompare

- Cryptorials

- CryptoSmile

- CyberFund

- decentralstation

- Digital Currency Group

- Draper Associates

- Fenbushi Capital

- Financial Cryptography

- Future\Perfect Ventures

- Hacking, Distributed and the blog of E. Gün Sirer

- Hexayurt Capital

- Hyperledger Project

- ICO Bazaar

- ICO Countdown

- ICO List

- ICOO

- ICO Rating

- ICO Timeline

- ICO Tracker

- IDG Capital Partners

- Khosla Ventures

- Lightspeed Venture Partners

- Marc Hochstein

- Medium posts on blockchain, cryptocurrency and decentralization

- Newbium

- Nick Szabo

- okTurtles

- OpenBazaar

- Pantera Capital

- Phil Windley

- Pierre-R Wolff’s Disqus comments

- Polychain Capital

- PrivateMarket

- Reddit/r/CryptoCurrency

- Ribbit Capital

- RRE Ventures

- TokenMarket

- Reddit’s ICO Crypto forum

- Smith + Crown

- TokenFactory, part of the 20/30 community

- Token Investor

- TokenMarket and its list of tokens and currencies

- Twitter tweetings on blockchain, cryptocurrency and decentralization

- Union Square Ventures, notably partners Brad Burnham and Fred Wilson

- Vinay Gupta in Medium and in Twitter

- Week in Ethereum

You’re welcome.

To improve it, that is.

Leave a Reply