Congress is about to take up Obama’s “economic program”. It will have line items which at least sound progressive and/or populist. We should remember the Bush administration ‘ethanol debacle’ in evaluating these. Ecology is about economy and conversely1,2. But the current “plan” seems to include a second “bailout” of the financial services industry. Hedge fund manager, the Late3 Larry Summers was on the TV machine assuring us that this time it will be different. Will it?4

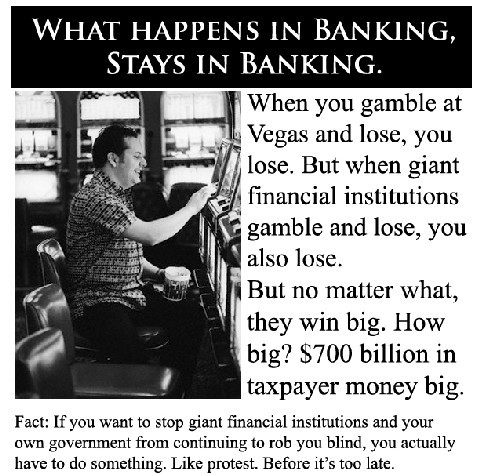

What, exactly, will the $1 Trillion this will end up costing us save? If we give money to the banks to keep them afloat, do people get to stay in their homes? Or do they foreclosed anyway? Do we save the banks and do nothing for the borrowers? Do we save an abstraction, The Economy, and do nothing for the people who are it’s reality?

David Korten, author of When Corporations Rule the World and The Great Turning, appeared on Democracy Now this morning to discuss an alternative economic plan described in his new book, Agenda for a New Economy: From Phantom Wealth to Real Wealth. Korten argues convincingly that it is possible to have an economy, i.e. a tool of our own creation, which serves the people who compose and create it, rather than the reverse. One of the ingredients, he suggests, is letting banks that deserve to fail, fail. In fact the teaser above the title is, Why Wall Street Can’t Be Fixed and How to Replace It. A video clip of his interview with David Brancaccio on PBS.

Holy Schumpeter’s Ghost, Batman!

If, on the other hand, The Late Larry succeeds in saving the “too big to fail” banks while the “too little to bother with” homeowners undergo ‘creative destruction’ into homelessness, even the Ghost of Schumpeter will rise up and smite him, yet again.

Some thoughts from me, but hopefully not inconsistent with David’s ideas:

$1 Trillion, that’s the projected cost of all the rounds of bailout planned. That would buy 4 million homes at $250,000 a crack. If the gummint, [i.e. “we the people”] just paid the ‘bad’ mortgages and gave people their homes, it would prevent a serious housing crisis from becoming a diaspora. But it would still reward the financial services industry for bad behaviour. How about if we the people, just write down the value of the mortgages to a point where a people can afford them? Coincidentally, they might then be more in line with “economic fundamentals” than the value determined by the “free market” on speculative steroids. We might have to nationalize the banks to do that. Krugman, this year’s Bank of Sweden Prize winner, thinks that would be a good idea.

If we do major write downs of mortgage values, we probably should qualify them by making the homes purchased “limited equity”. That is, a regulation on the price of a future sale of the home. We do not want them to become instruments of speculation in a future housing bubble. Perhaps consideration should be given to the amount of equity a given borrower has acrued. I don’t know the details.

[back after i get my broken nose looked at]

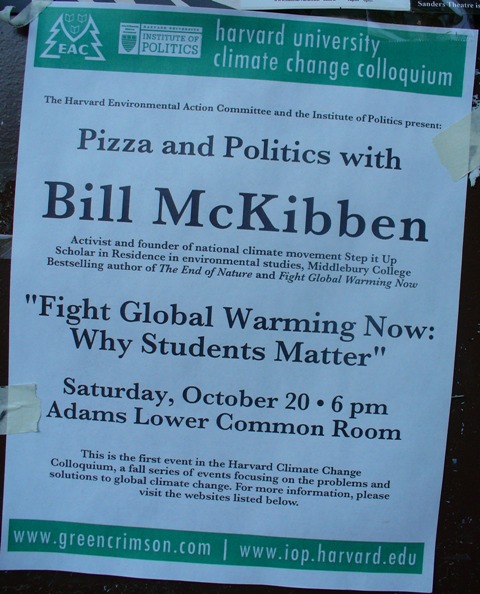

1See for example, the work of former Harvard Crimson President, Bill McKibben’s, Deep Economy.

2I met Steven Chu when he gave a talk at MIT about energy and Abrupt Climate ChangeA. At the beginning of his talk, he mentioned briefly that there is a lot of room to address carbon emission in the area of conservation, but he wasn’t going to talk about it. he was going to talk about controlling carbon emission of energy generationB. He was then the director of the Lawrence Berkeley National Laboratory. He was going to talking to people seeking careers in science and engineering research, i.e. usable results 10 or more years away. His appointment as Energy Secretary is very luke warm good news. It’s up to us to move his planning horizon in and his strategy towards conservation. His most amazing remark was after the talk. He turned to me with stunning earnestness. “These things are all really about money.” Well, that may be news to someone who worked for Bell Labs at the height of its monopoly [and the height of the Cold War], but if you got your PhD at Harlem’s CCNY, you pretty much know that. 🙂 🙂

3Obviously, I don’t believe that slinking off to be a hedge fund manager after being busted out of the Harvard Presidency amounts to resurrection. His appointment as Lamont University Professor, smells an awful lot like a deal to placate The FellowsC. Not resurrection. Not even close.

4One bit of good news. His mentor/co-conspirator, Harvard Fellow Robert Rubin, having lined his pockets with a chunk of taxpayer money for misguiding Citigroup, has resigned from Citigroup. But, I did not hear of him giving the money back.

AAbrupt Climate Change is much more descriptive of what matters to human life than global warming. It is the change of climate too rapidly for human societies to adapt that is the danger. I did not invent this phrase. I stole it from climate scientist Dr. Lonnie Thompson of Ohio State university. His talk before the 2007 meeting of the American Geophysical Union, recorded by Maria Gilardin of TUC Radio, is well worth listening to [lowband].

BAll of us non-Nobel physicists know that energy is not created or generated. It is converted. More accurately, we siphon off the flow of entropy. It is ‘free energy’ that really matters.

CHow much influence Summers’ mentor/co-conspirator Fellow Robert Rubin had I cannot say with precision. I can only say, “too much.”