Lobbying by financial firms is nothing new. In the past decade the finance and real estate industries more than doubled spending on lobbyists, reaching $474m in 2010, according to FT, citing figures from the Center for Responsive Politics. An IMF working paper published in 2009 found that banks which spent more on lobbying performed the worst, expanded their loan books faster, made riskier loans and had more loans go sour. It concluded, “Our analysis suggests that the political influence of the financial industry can be a source of systemic risk.”

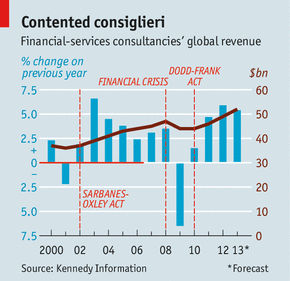

But the more interesting phenomenon has been the rise of financial consultants, which has been recently picked up by the media such as Time magazine and the Economist. According to the Economist, citing Kennedy Information, a research firm, “the global financial-services consulting business posted record revenues of $49 billion in 2012, a fifth of the consulting industry’s total”.

A firm stood out in this industry: Promontory. The firm was founded by former Office of the Comptroller of the Currency (OCC) head Eugene Ludwig after he stepped down from the government, and is staffed by some of the most senior regulators around the world, including the former chairs of U.S. Securities and Exchange Commission (SEC) and U.K. Financial Services Authority (FSA). If you are interested to know who’s who, the New York Times has helpfully consolidated a list. It is certainly a big business: The New York Times reported that “Mr. Ludwig regularly travels by private jet and earns more than $30 million annually, making him better paid than top executives at many big banks.” Indeed, Mr. Ludwig is living in one of the 20 most expensive homes in Washington D.C. too.

The firm claims to do “consulting” only, not “lobbying” (it has been a “registered lobbyist” but decided to give up that status in recent years). On the bright side, the firm helps companies to comply with new financial regulations as they are becoming growingly complicated. The regulators can also “outsource” part of their formal supervisory power to these financial consultancies, although how well this type of “self-regulation” works in practice remains doubtful, as it necessarily creates “a conflict of interest between the consultant’s loyalty to the company that pays it and to the regulator it must report to”. This draws scrutiny by the U.S. Congress recently, amid growing unease over their influence and their close ties to federal authorities.

But on the dark side, these people certainly would know where the regulatory loopholes are — and make huge money out of it. According to Bloomberg:

Promontory Interfinancial Network, a company that makes it easy for a wealthy depositor to keep FDIC-insured cash in separate accounts at multiple banks. It offers customers up to $50 million of FDIC insurance, 500 times the single-account limit approved by Congress.

…

The loophole Promontory exploits is the FDIC rule that allows an individual to open up federally insured accounts of up to $100,000 at an unlimited number of banks.

…

Promontory arranges for the customer’s money to be divided among banks, with each receiving less than $100,000 so all of the cash is FDIC insured. The receiving banks pay Promontory a fee, and in return, Promontory directs deposits to them.

And more interestingly:

Promontory charges banks more in fees, about $12.50 per a $10,000 one-year CD to get access to federally insured funds, than the FDIC itself charges in insurance premiums, typically $5-$7 per $10,000 deposited.

…

FDIC Chairman Sheila Bair says she’s surprised that Promontory gets a higher fee than her agency. “That’s an interesting question,” she says. “I’ll have to look into that.”

Oh yeah, you have to realize that the protection is not given by Promontory actually, but by the public (in terms of deposit insurance). In effect, they are making money out of nothing. That is good business.

Comments 1